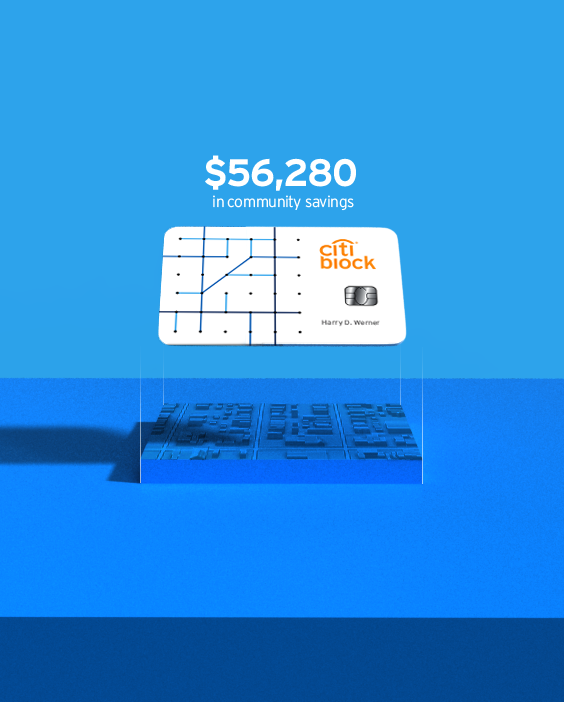

Citi block card

Generations of individuals in low-income communities are held captive in cycles of financial immobility. How do we loosen the grip of the cycle and create a path forward?

Create a first-of-its kind credit card that helps low-income individuals responsibly build their credit.

A geo-fenced credit card that gives back to the people and communities it serves.

The First Savings Card

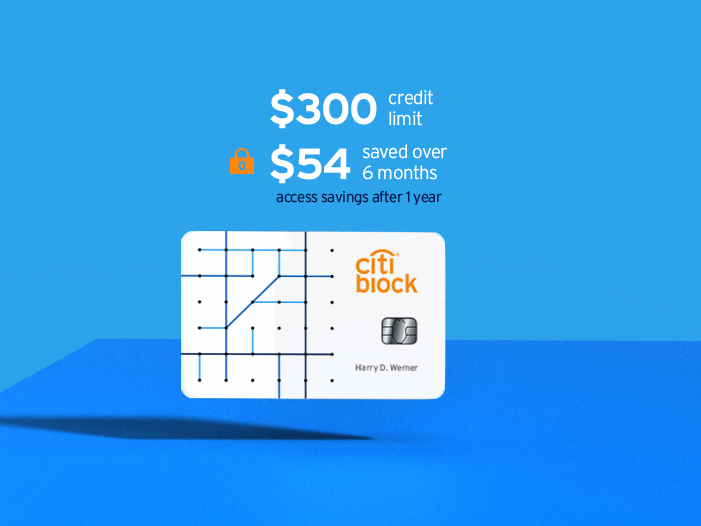

Individuals who use The Citi Block Card and maintain responsible financial habits receive direct deposits to a linked savings account of:

- 3% for purchases in their neighborhood

- 2% for purchases in their city

- 1% on all other purchases

Application Process

Most credit card applications boast 60-second approval rates, with little consideration given to the applicant's financial literacy.

This application process functions differently:

- Individuals have to be referred by employers to apply

- The application is a financial literacy and credit education online course

- Applicant must pass the course to get credit approval

Mitigating Risk

As an alternative to secured credit cards, initial card limits would be low, encouraging safe spending while avoiding overspending and debt

As cardholders earn savings, set minimum term lengths will encourage long-term savings and prevent monthly withdrawals. Money accrued during this time could also serve as the securitydeposit

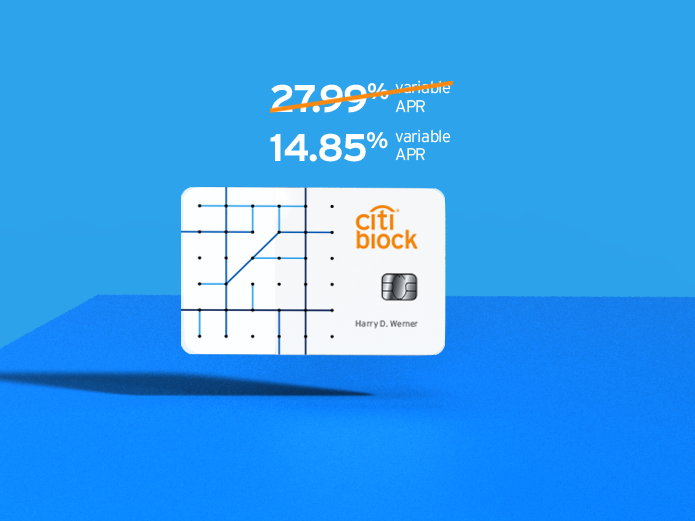

Reward safe spenders

Similar to how auto insurance companies reward safe drivers, this program would reward safe spenders: giving opportunities to extend limits, reduce fees or lower interest rates with good habits and continuing financial education courses.

Building Blocks to Investing

Demonstrate perfect habits for the opportunity to transfer accrued savings to a mutual fund of like-minded neighbors.

- Mutual funds will be created specifically for each neighborhood, so that everyone within the community can grow together

- Investment-focused courses would be available at this time to responsibly educate those who graduate to this next level

Designing the Block

- A base of black dots reflects the underling grid structure of each city.

- For each neighborhood, we focus in on a central, high-traffic location. Then, lines are down through the grid to match this specific layout.

- We use three blues for these lines to create more contrast and highlight the different road structures. Darker to lighter blues reflect larger to smaller roads.

Block Card Rollout

Identifying 3% Zones

Moving communities from cash to credit by providing them with the technology to adopt credit cards, and waiving the transaction fees for Citi Block cardholders.

And to help the community differentiate between 3% zones, we’ll give participating businesses Citi Block window stickers.

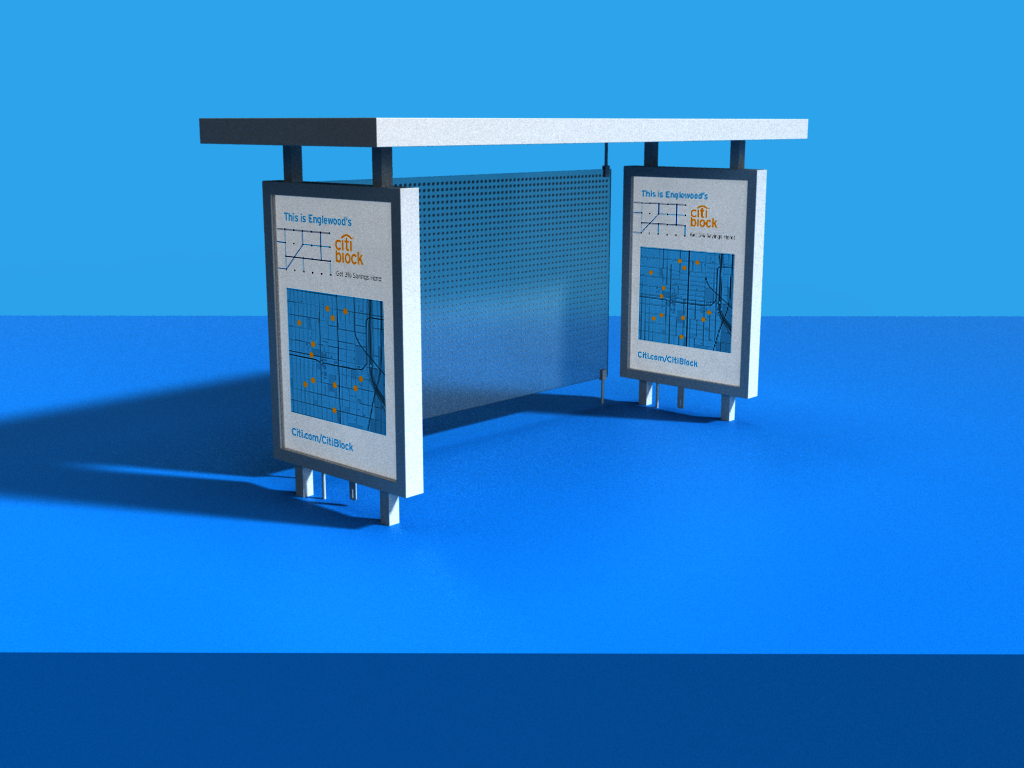

Bus Stop Block Atlas

Customized for different areas, bus shelter posters will map out local businesses within neighborhood limits to show where Citi Block cardholders can get 3% savings.

App-Based Education

Create a DuoLingo-inspired app consisting of visual and audio games to help users learn the language of personal finance and build the skills to responsibly manage credit and maintain financial security.

- Passing specific modules can help cardmembers qualify for lower rates and mutual fund initiatives

collaborators

Stacy Burghardt

Bryan Miguel

Mary Ergul

Work